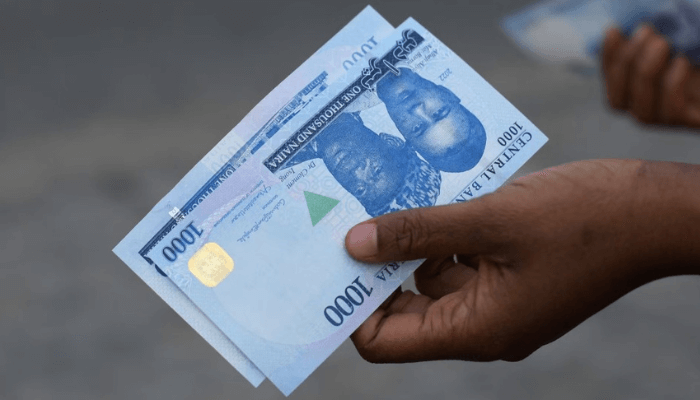

Nigeria’s naira hit a new low against the dollar as the country’s companies look to reduce their exposure to the US currency on expectations that the local sector’s woes will continue.

The naira fell more than 8% to 1,699 naira to the dollar on Wednesday as the supply of U.S. dollars in the Nigerian market nearly halved to $176 million, according to FMDQ data compiled by Bloomberg.

Afrinvest West Africa, a Lagos-based investment bank, predicts the naira could fall further to between 1,700 and 1,800 to the dollar by the end of the year as dollars remain in short supply locally. said analyst Nathanael Dis.

This bleak outlook makes borrowing costs much higher in naira and hinders President Bola Tinubu’s goal of attracting more foreign capital to Nigeria when he eased currency controls last year, even as the dollar Companies with debt are being urged to reduce their debt if possible.

“We are still seeing volatility in the naira and confidence in the naira is still limited,” said Muyiwa Oni, an analyst at Stanbic IBTC Bank. “The biggest takeaway is that as an organization we can’t control the movement of the naira, but we can reduce the risk.”

On September 9, Nigeria Breweries, a division of Heineken NV, announced plans to repay 328 billion naira ($197 million) in external debt.

Related article: Naira starts October at record low of 1,669.15/$ on official foreign exchange market

A few days later, Ecobank Nigeria announced that it would convert up to $200 million in dollar loans into naira to reduce currency risks. The Togo-based Ecobank Transnational unit also reported a 77% decline in pre-tax profit due to the weaker naira.

The Nigerian arm of MTN Group, the country’s largest mobile operator, announced in July that it had reduced its letter of credit debt to $100 million from $417 million in December.

The naira issue has seen multinational companies such as Unilever, Procter & Gamble, GSK, Sanofi SA and Diageo announce in recent months that they will reduce their exposure to Nigeria or sell to local companies or exit the country altogether. .

The moves reflect doubts that the situation will improve soon. A survey of 1,600 companies conducted by the central bank in August revealed that while businesses expect the naira to depreciate for the rest of 2024, they expect it to appreciate next year.

As Africa’s largest oil producer, falling oil prices have weighed on its currency.

David Cowan, chief Africa economist at Citigroup, said oil prices fell nearly 17% in the third quarter, although tensions in the Middle East have pushed Brent crude prices up a few dollars from recent lows. We expect further depreciation of the naira.

Currency issues complicate Tinubu’s efforts to spark slow growth in Africa’s most populous country. In addition to allowing the naira to float more freely after years of being held at an artificially high level against the dollar, it also partially eliminated fuel subsidies that will cost the country $10 billion in 2022.

The reforms were welcomed by international observers, but contributed to a cost-of-living crisis as inflation rose to its highest level in 28 years. This sparked mass demonstrations in early August that led to a crackdown by security forces that left at least 21 people dead.