Manufacturing’s contribution to Nigeria’s non-oil exports is at its lowest in five years as operators grapple with rising costs due to high borrowing costs and weak consumer spending.

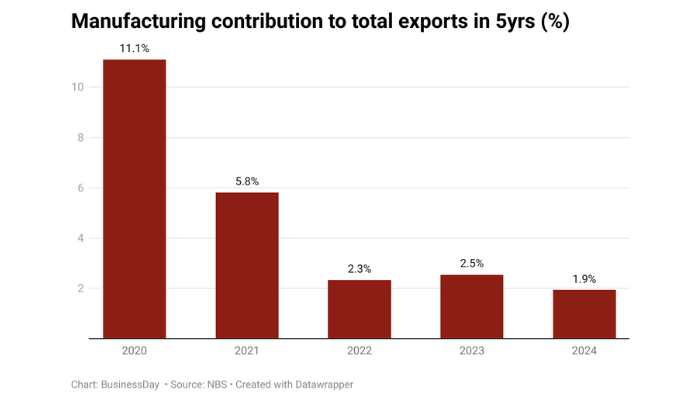

The contribution of manufacturing exports to total exports fell from 11.1% in the first half of 2020 to 1.9% in the first half of 2024, according to the latest Foreign Trade Report data.

In the first half of 2021 (H1), the sector accounted for 5.8% of total exports, while in the first half of 2022, that figure decreased by 2.5% to 2.3%. In 2023, the contribution of manufacturing to total exports increased slightly to 2.5%.

Related article: High interest rates reduce investment in manufacturing

Manufacturers blame continued rises in production costs and a deteriorating business environment that has squeezed profits, wiped out shareholder money and made local products less competitive.

They say the sector suffers from a lack of competitiveness as a result of poor infrastructure and financing, high energy and logistics costs, inconsistent government policy, heavy taxes and skills shortages. It is said that there is

“High production costs are a major factor contributing to the industry’s struggles,” Muda Yusuf, chief executive officer of the Center for the Promotion of Private Enterprise (CPPE), told Business Day.

Yusuf explained that Nigeria’s high cost of production and other challenges in the country’s business environment make it difficult for manufacturers to compete favorably.

“You know, you’re competing with a lot of other exporters from other parts of the world, many of whom have better infrastructure, better logistics, better financing, and all of that. ” he said.

“Right now, if you’re going into an export market and your domestic costs are high, you know you’re using diesel or gas in your production, so you’re borrowing money at 30% interest. The challenge is , the coat is so huge that by the time it reaches its destination, the product becomes uncompetitive,” Yusuf added.

He emphasized the need to improve the business environment for manufacturers to enable their products to compete favorably in the global market.

“This is a problem of the environment we have created for manufacturers. We need to improve the environment so that whatever we produce can be competitive in the world market. The language of the world market is competitiveness.” said Yusuf.

He reiterated that the manufacturing environment, including cost reduction and increased competitiveness, is critical to the sector’s growth and success in export markets.

In value terms, the country’s manufactured goods exports increased by 89.4 percent from 254.2 billion naira in 2020 to 480.82 billion naira in 2024. However, due to the devaluation of the naira, this does not necessarily mean that export volumes increased during this period.

Also read: “Currency exchange, taxes and electricity costs essential for manufacturing growth”

Uchenna Uzo, a marketing professor at the Lagos Business School, said Nigeria’s non-oil products are in great demand across the West African region as devaluation has made them cheaper.

Manufactured goods exports in the second quarter of 2024 amounted to N480.82 billion, an increase of 78.95 per cent from N268.7 billion in the first quarter of 2024 and 126.65 per cent from N212.14 billion in the second quarter of 2023.

The report also stated that total exports in the second quarter of 2024 were valued at N19,418.93 billion, an increase of 1.31 percent compared to N19,167.36 billion in the first quarter of 2024, 2023. It said this reflected an increase of 201.76 per cent compared to 6,435.13 billion naira in the second quarter.

The main exports of this sector are raw aluminum alloys exported to Japan and China with a value of N82.74 billion and N16.02 billion respectively.

“This was followed by floating or underwater drilling or production platforms worth NGN 81.69 billion for Namibia, and ships and other floating objects worth NNE 20.43 billion and NGN 16.59 billion for Cameroon and Togo, respectively. Structures for demolition were exported,” the report states.

According to the data, exports of manufactured goods by region mainly go to Africa at 225.87 billion naira, followed by exports to Asia at 156.07 billion naira and exports to America at 56.24 billion naira. It became.