[ad_1]

(Bloomberg) — Asia rose on Thursday as U.S. peers hit new highs ahead of inflation data that could dictate the Federal Reserve’s policy easing in coming months. Stocks rose.

Most Read Articles on Bloomberg

Stock prices in Japan, South Korea, Australia, and China all rose. Stocks in Hong Kong and mainland China rose after the People’s Bank of China released details of its liquidity tools that will be available to institutional investors to buy stocks. The tool was first announced last month. Mainland stock benchmarks posted their steepest decline in four years on Wednesday as a rally in China’s markets exacerbated trading volatility.

US Treasuries were firm in Asian trading as yields rose in New York on Wednesday. The Bloomberg Dollar Spot Index was little changed after rising for the past eight sessions. The yen was stable against the dollar after falling to around 149 yen to the dollar on Wednesday, its lowest level since mid-August. Korean bond futures rose on the news that it was included in the FTSE Russell World Government Bond Index.

There are few signs of additional support for China’s economy and financial markets, pointing to further volatility in Chinese stocks. Hong Kong stock volatility indicators eased slightly on Wednesday, but remained well above the historical average. One issue for investors is whether there will be more fiscal stimulus. Officials announced Wednesday that a press conference on the matter would be held over the weekend.

“There’s definitely a lot of optimism and hope heading into the meeting” regarding fiscal transparency, Yuting Xiao, macro strategist at State Street Global Markets, said on Bloomberg TV. He added that broader themes such as lower U.S. borrowing costs and public support for the Chinese economy will support risk sentiment. “If China makes it clear, there will be another layer on top of that.”

According to Morgan Stanley, there will be a high hurdle for China’s Ministry of Finance to convince the market at a press conference on Saturday that the reflation axis is back on a firmer footing.

Elsewhere in Asia, Taiwan Semiconductor Manufacturing Co. on Wednesday reported a better-than-expected 39% rise in quarterly sales. Taiwanese markets are closed on Thursdays.

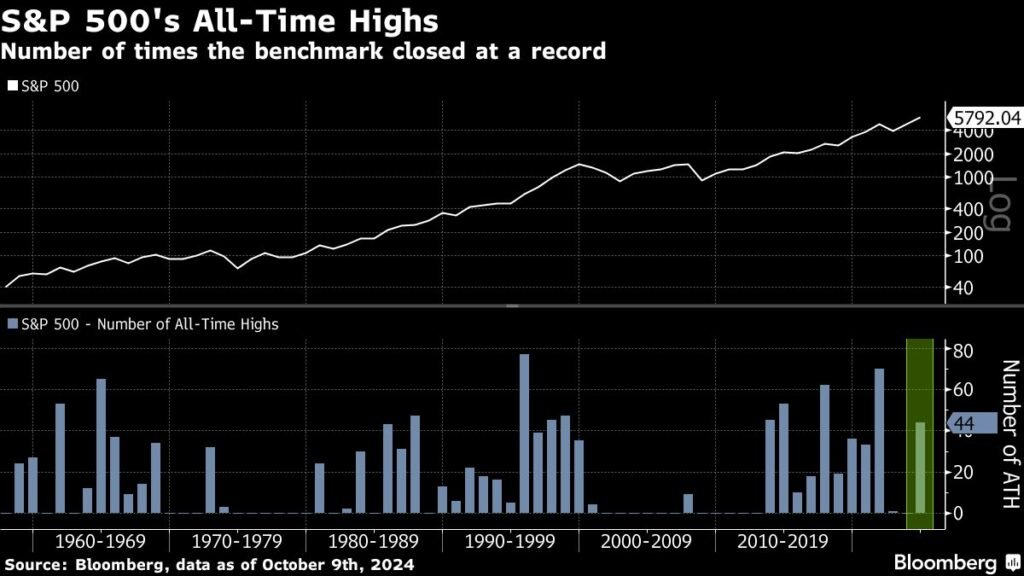

Back in the US, tech stocks again led the rally on Wednesday, with the S&P 500 rising 0.7% to its 44th all-time high of the year. Apple rose 1.7%. Nvidia ended a five-day rally, and Tesla fell slightly ahead of the launch of its robotaxi. Alphabet fell 1.5% on news that the U.S. is considering breaking up Google in a historic antitrust case against the big tech giant.

the story continues

Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, said the rally in tech stocks reflects previous weakness that represents an attractive buying opportunity. “We remain positive about the outlook for the technology sector and artificial intelligence,” she said. “We believe we need to take advantage of volatility to build long-term AI exposure.”

U.S. consumer price data due later Thursday is expected to show further slowing in inflation and confirm expected Fed easing in coming months. Nevertheless, market prices suggest that another 50 basis point rate cut is highly unlikely following last week’s strong jobs report.

Markets on Wednesday traded minutes after the latest Fed meeting showing Chairman Jerome Powell received some pushback on September’s 0.5 point rate cut, with some officials hoping for a modest rate cut. I took it and barely moved.

“Policymakers agree that inflation is slowing, potentially weakening job growth,” said TradeStation’s David Russell. “This puts rate cuts on the table if needed. The bottom line is that Mr. Powell could push the market back towards the end of the year.”

inflation data

The consumer price index is expected to rise 0.1% in September, the smallest increase in three months. Compared to last year, CPI rose by 2.3%, marking the sixth consecutive year of slowdown and the mildest level since early 2021. The index, which excludes the volatile food and energy categories, is expected to rise 0.2% as it better captures underlying inflation. 3.2% month-on-month and 3.2% from September 2023.

“The Fed’s decision to shift its focus from inflation to the labor market may mean that tomorrow’s inflation data, including CPI, will be less likely to move markets as much as in the past,” said Matthew Weller of Forex.com City Index. It means,” he said.

“Despite these logical observations, this month’s CPI report could still add to market volatility on the back of Friday’s impressive jobs report, signaling possible new upside risks to inflation,” he said. It’s about what we do,” he added.

Meanwhile, San Francisco Federal Reserve President Mary Daly said she expects the U.S. central bank to continue lowering interest rates this year to protect the labor market. “I think two more cuts this year, or one more cut this year, is really within the realm of possibility,” Daly said Wednesday, referring to either a one-quarter or two-quarter point cut.

In commodity markets, oil edged higher as U.S. crude inventories expanded and traders monitored China’s fiscal policy plans. Gold prices were little changed on Thursday after falling for the past six sessions.

This week’s main events:

US CPI, new unemployment insurance claims, Thursday

Fed’s John Williams and Thomas Barkin speak on Thursday

JPMorgan and Wells Fargo kick off earnings season for big Wall Street banks on Friday.

US PPI, University of Michigan Consumer Sentiment, Friday

Fed’s Laurie Logan, Austan Goolsby and Michelle Bowman speak on Friday

The main movements in the market are:

stock

S&P 500 futures were little changed as of 10:34 a.m. Tokyo time.

Nikkei 225 futures (OSE) rose 0.5%

Japan’s TOPIX rose 0.4%

Australia’s S&P/ASX 200 rose 0.6%

Hong Kong’s Hang Seng rose 2.4%.

The Shanghai Composite rose 0.5%.

Euro Stoxx50 futures little changed

currency

Bloomberg Dollar Spot Index little changed

The euro was almost unchanged at $1.0943.

The Japanese yen remained almost unchanged at 149.18 yen to the dollar.

The offshore yuan rose 0.1% to 7.0838 yuan to the dollar.

cryptocurrency

Bitcoin rose 0.4% to $60,625.44

Ether rose 1.3% to $2,386.23

bond

merchandise

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP