[ad_1]

CNN —

A federal appeals court in Washington, D.C., on Wednesday denied a government watchdog’s request to block a ruling that would have made way for legal political gambling in the United States, allowing prediction markets to offer election betting.

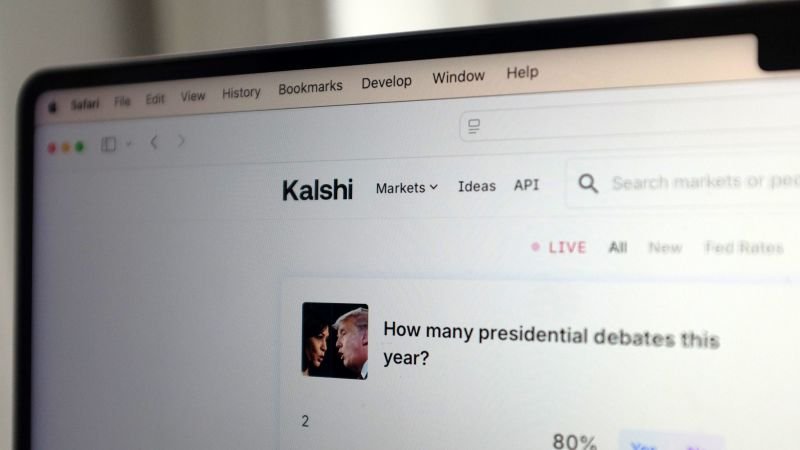

Kalsi, an online platform that allows users to bet on the outcome of future events, reinstated the Congressional Control Contract hours after the ruling, allowing Americans to bet on which political party will control the House and Senate in 2025. I made it possible. -based startups will launch more election markets.

On Wednesday, a three-judge panel unanimously ruled that the Commodity Futures Trading Commission, which had argued that the bets were illegal and could undermine the integrity of elections, is now hearing an appeal. The court ruled that it had not been possible to prove how the commission or the public would suffer “irreparable harm” in the interim. ”

“In short, the concerns expressed by the committee are understandable given the uncertain impact Congressional Control Contracts have on elections that are the cornerstone of our democracy,” Judge Patricia Millett wrote for the D.C. Circuit Court of Appeals. I wrote it. “However, it is debatable whether the legal text authorizes the Commission to prohibit such event contracts, and the Commission finds that during the pendency of this appeal, Kalsi was permitted to operate the exchange. has not demonstrated that a risk to the integrity of the election is likely to materialize.”

Wednesday’s ruling allows the agency to make another bid to suspend the judgment while the appeals case proceeds “if more concrete evidence of irreparable harm is found.”

Mr. Carsi first made the contract public on September 12, after U.S. District Judge Gia Cobb in Washington rejected the commission’s proposal to block the platform from offering the contract. The CFTC immediately appealed the judge’s decision. The D.C. Circuit Court of Appeals then temporarily blocked Kalsi’s betting offer and considered the agency’s proposal for a moratorium.

Mr. Carsi and representatives of the CFTC did not respond to requests for comment.

Karshi co-founder Tarek Mansour celebrated Wednesday’s ruling.

“The US presidential election market is legal. Officially. Finally. Kalsi won,” he told X.

Stephen Hall, legal director and securities expert at Better Markets, a nonprofit organization that advocates for financial reform, said the court’s order marks “a sad and ominous day for the integrity of American elections.” .

“Using AI, ‘deepfakes’ and social media to manipulate voters and influence election outcomes is already all too real. , the danger is made even more dangerous by the prospect of immediate profits,” he said in a statement.

Kalsi has long argued that the deal is in the public interest because it provides accurate data for election predictions and allows people to hedge bets on different outcomes. The platform also points to the rise of Polymarket, an offshore, unregulated crypto-based prediction market that gained popularity after the CNN debate in June. On the platform, users have bet more than $1 billion on presidential elections.

The ruling came nearly two weeks after the committee heard arguments on whether to lift the suspension of Mr. Carsi’s parliamentary contract. In a hearing that lasted several hours, the judges pressed officials on whether the market would undermine the integrity of the upcoming November election.

“I don’t want to get too dramatic, but we live in a country where tens of millions of Americans believe the last presidential election was stolen,” CFTC General Counsel Rob Schwartz said. .

Schwartz argued that political betting markets are different from “regular futures contracts” with reliable “objective” indicators such as published indices or government reports. Schwartz said the sources of information absorbed by election markets can be “opaque and unreliable,” such as public opinion polls and fake news reporting, with methodologies that are not public, making them potentially susceptible to manipulation. suggested.

Kalsi’s lawyer, Yaakov Ross, touted the benefits of platforms like Kalsi, arguing that the election would have serious economic consequences that “real people want to avoid.”

“The election itself can cause certain companies to rise in value or fall in value. That’s the risk. So to avoid that risk, you need to buy event contracts that take that into account. “I guess so,” Ross said.

While the legal dispute with Mr. Kalsi continues, the CFTC has also launched a broader crackdown on event-based gambling. Earlier this year, the CFTC proposed rules that would explicitly prohibit contracts related to the outcomes of elections, awards ceremonies, sports, and other events.

CFTC Chairman Rostin Behnam said in a May statement that there has been a “significant increase in the number of event contracts listed for trading on CFTC-registered exchanges,” and that these contracts are making it easier for the financial markets regulator to The CFTC, he said, “will be forced into a far greater position.” with the mandate and expertise of Congress. ”

[ad_2]

Source link