(Bloomberg) — U.S. inflation will likely slow by the end of the third quarter, reassuring the Federal Reserve as it shifts its policy focus to protecting the labor market.

Most Read Articles on Bloomberg

The consumer price index is expected to rise 0.1% in September, the smallest increase in three months. Compared to the previous year, CPI rose by 2.3%, marking the sixth consecutive year of slowdown and the most moderate level since early 2021. The Bureau of Labor Statistics is scheduled to release the CPI report on Thursday.

The measure, which excludes the volatile food and energy categories, provides a better picture of underlying inflation, which is expected to rise 0.2% month-on-month and 3.2% from September 2023. There is.

A gradual slowdown in inflation, following unexpectedly strong September employment growth announced on Friday, may prompt policymakers to opt for a modest rate cut at their next meeting on November 6-7. suggests that.

Fed Chairman Jerome Powell said the outlook, which officials released at the same time as the September rate decision, was a point toward cutting rates by a quarter at the last two meetings of the year.

The CPI and producer price index are used to inform the Federal Reserve’s preferred measure of inflation, the Personal Consumption Expenditure Price Index, which is expected to be released later this month.

Bloomberg Economics says:

“We expect headline CPI to be subdued in September, but core indicators are firmer. Mapping to PCE inflation (the Fed’s preferred price index), core inflation is on pace to be consistent with the 2% target. Overall, we do not believe this report will have a significant impact on the FOMC’s confidence that inflation is on a sustained downward trend.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Wu, Chris G. Collins, economists. Click here for complete analysis

Friday’s report on producer prices, a measure of inflationary pressures faced by businesses, is also expected to show subdued inflation. On the same day, the University of Michigan releases its Consumer Confidence Report for October. The Fed will also release minutes of its September meeting on Wednesday.

Neel Kashkari, Alberto Mussallem, Adriana Kugler, Rafael Bostic and Rory Logan are among a series of Fed officials who will speak next week.

story continues

In Canada, authorities are scheduled to release final employment figures before the next Bank of Canada rate decision, which will be important information for Governor Tiff Macklem, who hopes for further easing in the labor market. The central bank will also release a survey on business and consumer expectations for economic growth and inflation.

Elsewhere, central banks from New Zealand to South Korea could cut interest rates, France will release its budget and the European Central Bank is expected to release minutes from its September policy meeting.

Click here to see what happened over the past week. Below is a summary of what will happen next in the global economy.

Asia

This is a critical week for monetary policy in Asia, with two central banks likely to cut rates, and another inching closer to doing so.

The Reserve Bank of New Zealand expects to continue its switch to an easing cycle in August by cutting its policy rate by 0.5 percentage point to 4.75% at Wednesday’s board meeting as weak employment data raises labor market concerns. has been done.

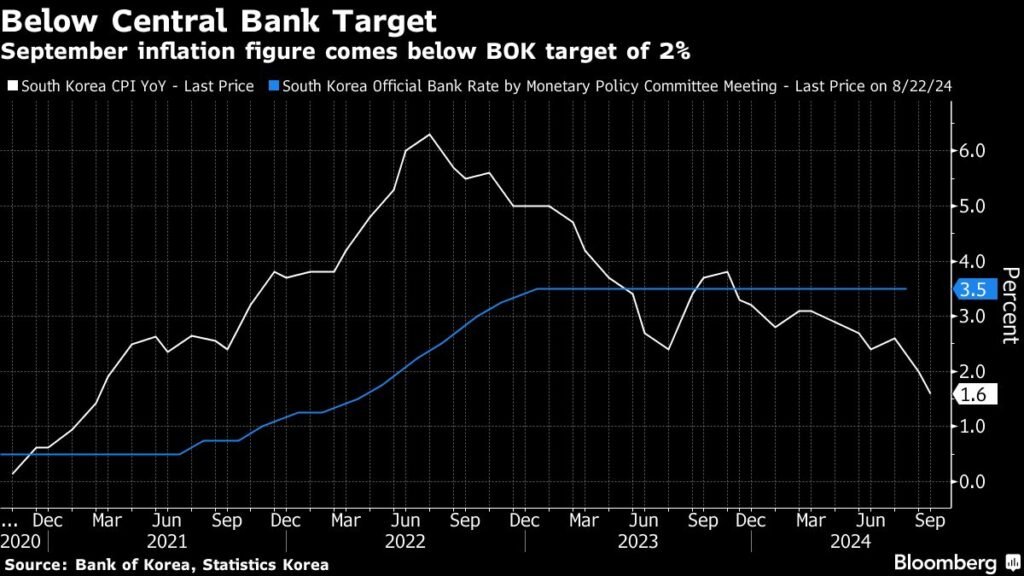

The Bank of Korea is likely to lower the benchmark by a quarter of a percentage point on Friday as inflation slows to its lowest pace in more than three years, but the decision will be delayed until housing market conditions have sufficiently cooled. It depends on whether you are there or not.

The Reserve Bank of India is seen keeping repo rates and cash reserve ratios stable, with many economists expecting the repo rate to be cut by a quarter of a percentage point by the end of the year. And Kazakhstan’s central bank is expected to decide on Friday whether to restart its easing campaign.

On Tuesday, the Reserve Bank of Australia will release the minutes of its September meeting, which could shed light on the deliberations that led to maintaining its hawkish policies, and RBA No. 2 Andrew Hauser will also speak on the same day.

Japan has wage statistics and household expenditure data, both of which are of interest to the new government ahead of a general election later this month.

Singapore is scheduled to release its third-quarter gross domestic product data between Thursday and Monday, with consensus forecasts for year-on-year growth to accelerate.

Data released on Sunday showed Vietnam’s economic growth rose above expectations in the last quarter, boosted by manufacturing and exports, before September’s super typhoon caused widespread damage and halted production at farms and factories. It was shown that it accelerated outward.

Consumer inflation statistics will be released by Thailand and Taiwan, while the Philippines and Taiwan will release trade statistics.

Europe, Middle East, Africa

The plight of Germany’s manufacturing industry will be in the spotlight with factory orders announced on Monday, industrial production on Tuesday, followed by government economic forecasts on Wednesday.

Officials are poised to completely abandon hopes of achieving expansion this year, according to people familiar with the matter. The Süddeutsche Zeitung newspaper reported over the weekend that the city of Berlin is forecasting negative growth of 0.2% in 2024.

In France, Prime Minister Michel Barnier’s government is scheduled to present its 2025 budget on Thursday, as the country struggles to rein in its budget deficit. Fitch Ratings plans to potentially issue a rating on the country after the market closes on Friday.

For the European Central Bank, Wednesday will be the last day for officials to speak publicly about monetary policy before a blackout period begins ahead of a decision on Oct. 17 when a rate cut is almost certain.

Chief economist Philippe Lane, Joachim Nagel, president of the Bundesbank, and François Villeroy de Galhau, president of the Banque de France, are scheduled to attend. The transcript of the previous meeting was made public on Thursday and could provide clues about the upcoming ruling.

Meanwhile, in the UK, Friday’s GDP figures will provide an indication of the health of the economy in August, following comments from Bank of England Governor Andrew Bailey opening the door to more aggressive easing.

Two Riksbank officials are scheduled to speak after Sweden’s central bank cut interest rates for the third time in September. Sweden’s monthly growth indicators will be released on Thursday.

On a different note, Egyptian authorities expect inflation to slow again in September after accelerating slightly in the previous month. The last reading was 26%, slightly below the central bank’s base rate of 27.25%.

Three central bank decisions are expected in the region:

On Tuesday, Kenya’s Monetary Policy Committee is expected to cut the key policy rate by a quarter of a percentage point for the second consecutive quarter to 12.25%. Inflation is expected to remain below the 5% target in the short term after slowing to a 12-year low in September.

On Wednesday, Israeli authorities are likely to keep interest rates on hold at 4.5% again, even as other countries begin or continue easing cycles. The war with Hamas in the Gaza Strip and escalating conflicts with Hezbollah and Iran are weighing on the shekel, which is near a two-month low. The country’s credit rating was recently downgraded by Moody’s and S&P.

Serbia’s central bank will make its monthly decision on Thursday, potentially continuing monetary easing after cutting interest rates by a quarter of a percentage point in September.

latin america

By the end of the week, third-quarter consumer price data for all five of Latin America’s major inflation-targeting economies are expected to be released.

Brazil’s undeniable overheating of the economy and prices is likely to continue in September, while statistics are expected to decline in Chile, Colombia and Mexico. All four central banks have set an inflation target of 3%.

In Brazil, apart from the central bank’s expectations survey released on Monday, the August retail sales report may show a slight slowdown from the previously strong 2024 data.

The minutes of Banxico’s September 26 meeting will be a highlight for Mexico. Policy makers struck a dovish tone in their forward guidance statement after the decision, after cutting interest rates by 25 basis points to 10.5% for the second year in a row.

Peru is likely to cut its central bank interest rate from the current 5.25% for the third year in a row after September’s month-on-month deflation and annual rate of 1.78% were below target.

Argentina’s President Javier Millei’s fight against inflation, which has rapidly brought down overheating consumer price increases, appears to be stalling, with the monthly print rate running at nearly 4%. Economists surveyed by the central bank say they expect a slight slowdown in the future under the current policy mix.

–With assistance from Robert Jameson, Laura Dillon Kane, Piotr Skolimovsky, Monique Vanek, and Paul Wallace.

(Latest information on Germany in EMEA section)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP