(Bloomberg) – Investors accustomed to years of U.S.-China trade wars appear to be braving the risk of further tariff hikes after the U.S. presidential election and favoring Chinese assets as they bet on more economic stimulus.

Most Read Articles on Bloomberg

Regardless of whether a new U.S. leader takes office, be it Donald Trump or Kamala Harris, global asset managers expect hostility toward China to intensify. But rather than shun Chinese assets entirely based on that outlook, we expect Chinese government policy to continue to support equities, especially those listed on the mainland.

A dovish central bank is also seen as a boon for local government bonds. However, the mood is less optimistic regarding the yuan, and monetary easing to offset post-election headwinds could depreciate the Chinese currency.

The view is that another term for President Trump, who has advocated imposing 60% tariffs on all Chinese imports, would be more negative overall for the Asian country than a Harris victory. is dominant. Still, fears of a market shock like the one seen in the 2016 Republican victory are waning. Trade wars are no longer a novelty, and investors are steadily hedging risks from China amid heightened geopolitical tensions under the current administration.

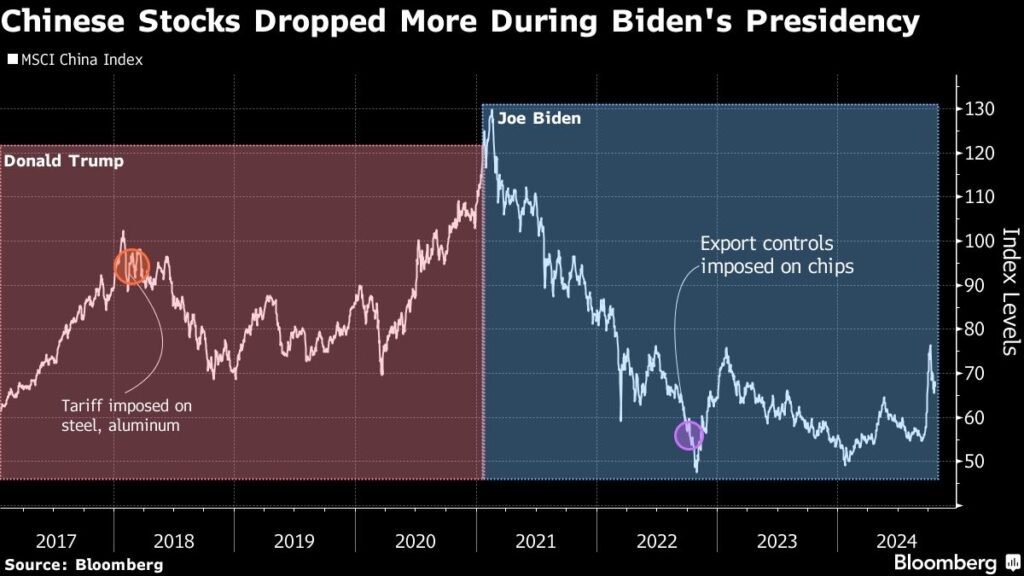

Investors are also well aware that the MSCI China Index, which nearly doubled during President Trump’s term, is down more than 40% so far under President Joe Biden, and China’s It highlights how a myriad of factors, including regulatory crackdowns, are influencing market performance.

“In my opinion, policy stimulus is more important for the Chinese economy and the stock market than the US election,” said Jiang Shi Cortesi, portfolio manager at Gum Investment Management in Zurich. “The Chinese government is preparing more policy tools to respond to potential trade measures if President Trump wins.”

Less than two weeks into the election, the close race between Trump and Harris has made it difficult for funds to predict the outcome and take positions, and the fund has focused more attention on China’s policy signals. It is explained that

opportunity to buy

Chinese stocks have made a dramatic comeback since the onslaught of stimulus in September, with the CSI300 index up more than 20% from last month’s lows. Jefferies and M&G Investments are among the companies that see the election selloff as an opportunity to buy more Chinese stocks.

Vice Finance Minister Liao Min said in an interview with Bloomberg on Friday that the stimulus package is centered on boosting domestic demand and achieving the country’s annual growth target. Consumption has become an important consideration in China’s fiscal policy-making, he said, pointing to efforts to fund trade-in programs for consumer goods.

story continues

Fabiana Fedeli, M&G’s global chief investment officer for equities, multi-asset and sustainability, said that “if Trump were elected, there would be a lot of volatility, particularly in Chinese stocks,” but that future policy support could have a negative impact. He said some of it could be offset. “If anything, if there’s a big drop, we’ll probably take that as a buying opportunity.”

Many investors argue that stocks listed on the mainland will be better protected from electoral swings than those traded in Hong Kong or the United States, which are easier to access from abroad.

“China’s policy impulses are very strong and the election should not affect many of them, especially high-quality state-owned enterprises and high-dividend stocks,” said John Wisard, head of Asia special situations at Pictet Asset Management. said. .

Tariff threat

That correlation is now reduced compared to 2018-2019, when President Trump’s tweets on trade and tariffs sent shockwaves through global financial markets, according to a Bloomberg Economics analysis.

At the time, “the world was integrating, so the tariffs and policies from the U.S. were a bit of a shock not just for investors but also for companies in the region,” said Andrew Swan, head of Man Group’s Asia business excluding Japan equities. he said. He spoke in an interview with Bloomberg TV. “The world now understands that we live in a different kind of geopolitical situation.”

Indeed, exports have been a rare bright spot as China struggles with a slowdown in domestic demand, meaning trade tensions could pose a bigger economic headwind than in the past. According to TS Lombard, China is more vulnerable to tariffs than it was in 2018, and President Trump’s victory will reduce stimulus from Beijing, which is choosing to continue avoiding window dressing until U.S. policy is clearer. It may be delayed.

Harris’ campaign message suggests that while she won’t go easy on China, she sees no room for improvement in further rifts between the world’s two largest economies. She criticized President Trump for starting the trade war and likened the tariffs to a “Trump sales tax” that would raise prices across the board for middle-class families.

Manulife Investment Management sees domestic bonds issued by state-owned enterprises and dollar bills as attractive, and expects the People’s Bank of China to maintain its dovish stance.

If President Trump wins and imposes additional tariffs, “China could tolerate a weaker renminbi to some extent to mitigate the negative impact on exports,” said Kiyong Song, Asia lead macro strategist at Société Générale. There is a gender,” he said. “As a result, there will be more room to cut policy rates, allowing China’s interest rates to fall, which should be bullish for Chinese government bonds.”

short renminbi

Currency traders are largely bearish on the yuan in a Trump-win scenario, but expect a rebound in a Harris-win scenario. The yuan fell to its lowest level in 10 years in August 2019 as the trade war escalated, but President Trump’s term ended with the yuan appreciating by about 6% from the start.

The dollar has strengthened this month as the possibility of a Trump presidency fuels bets on higher inflation and higher Treasury yields.

Chidu Narayanan, Head of Macro Strategy Asia Pacific at Wells Fargo Securities Singapore “It’s expensive.” He added that the company’s position has been tilted towards the renminbi’s strength against the dollar since late September, and it is also long on renminbi volatility.

–With assistance from Abhishek Vishnoi and Joanne Wong.

(Adds comment from Deputy Minister of Finance in 9th paragraph)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP